March 20, 2025 HGEA-HHSC Temporary Hazard Pay

Frequently Asked Questions

1. I am a current employee of HHSC East Hawaii Region. If eligible for Temporary Hazard Pay, how will I be paid?

For current employees, these payments will be processed separately from your bi-monthly paycheck. If you are currently enrolled in direct deposit, your payments will be via direct deposit. If you are not currently enrolled in direct deposit, you will receive a check in paper form. Check pick-up locations are outlined below for our various HHSC EHR locations:

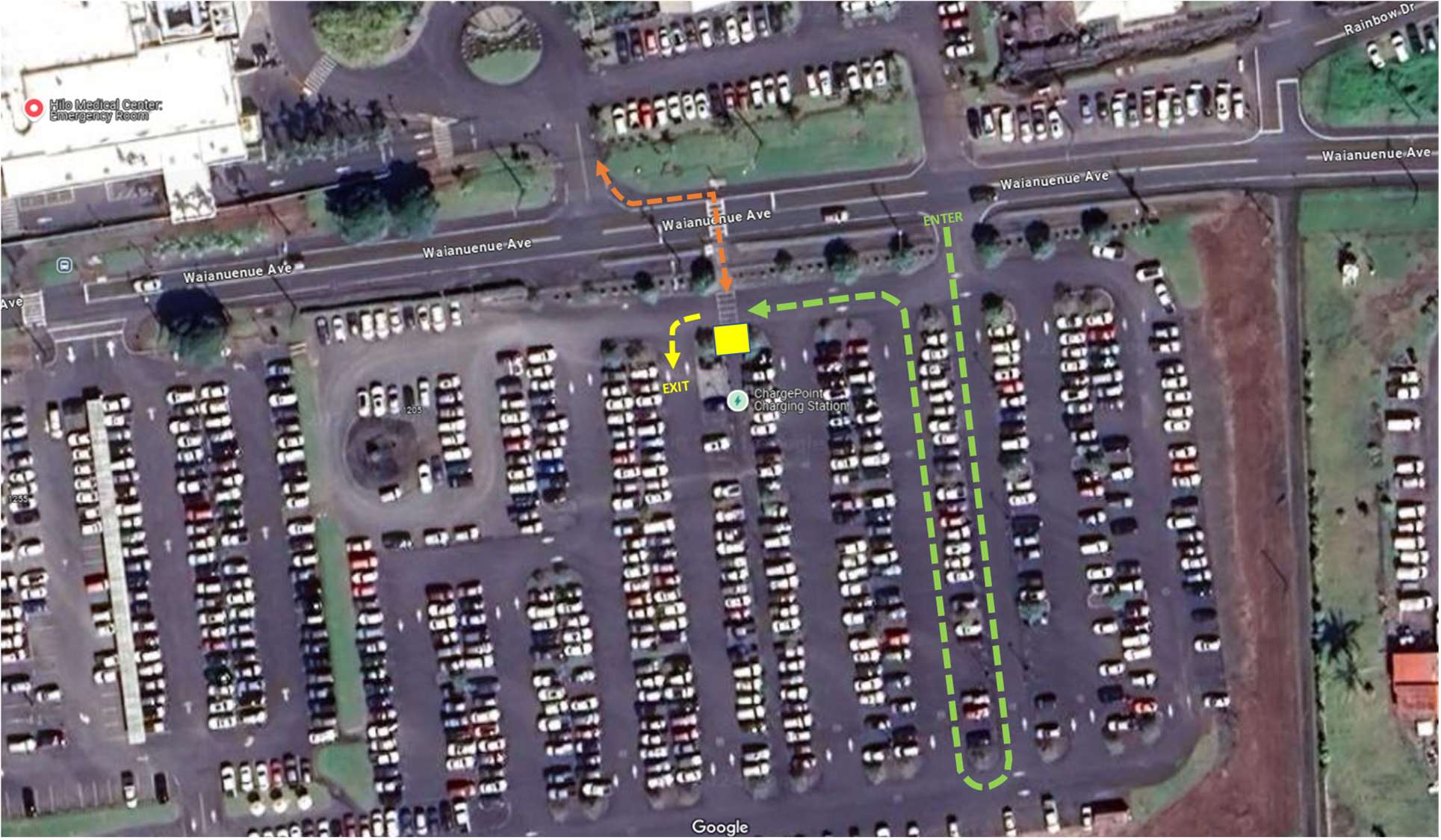

- Hilo Benioff Medical Center employees, paper checks will be available for pick up with a valid photo ID, at the Employee Parking lot across Yukio Okutsu State Veterans Home – see yellow square in map below for our pick-up tent location. Checks will be available for pick up on March 20th from 1230pm to 330pm and March 21st from 830am to 315pm. (Please follow signage).

![]() Honoka’a Hospital employees, paper checks will be available for pick up with a valid photo ID at the Honoka’a Hospital Business Office.

Honoka’a Hospital employees, paper checks will be available for pick up with a valid photo ID at the Honoka’a Hospital Business Office.- Ka’u Hospital or the Ka’u Clinic employees, paper checks will be available for pick up with a valid photo ID at the Ka’u Hospital Business Office.

- East Hawaii Health Clinic (EHHC) employees, your pick-up location will be the same as Hilo Benioff Medical Center employees. Please see bullet point one for your pick-up information.

2. Will I be taxed on my Temporary Hazard Pay payment?

Per the Settlement Agreement, “HHSC shall withhold all taxes and retirement contributions required by law for the affected employees. Union dues will also be deducted from this payment. Affected Employees are responsible for all tax liabilities incurred as a result of this Settlement Agreement.”

3. Will these Temporary Hazard Pay payments be reported to the Employees’ Retirement System (ERS)?

Yes, per the terms of the Settlement Agreement, the Employer will report payouts to the ERS, broken down by pay period.

4. Will these Temporary Hazard Pay payments affect my ERS retirement benefits?

The Temporary Hazard Pay lump sum payments are creditable for ERS purposes only for employees who became an ERS member before July 1, 2012 pursuant to Hawaii Revised Statues, Chapter 88-21.5.

5. I am a former employee of HHSC East Hawaii Region. If eligible for Temporary Hazard Pay, how will I be paid?

Former Hilo Benioff Medical Center employees, will be issued a paper check. Paper checks will be available for pick up with a valid photo ID at the Employee Parking lot across Yukio Okutsu State Veterans Home – see yellow square in map below for our pick-up tent location. Checks will be available for pick up on March 20th from 1230pm to 330pm and March 21st from 830am to 315pm. (Please follow signage).

- Former Honoka’a Hospital employees, will be issued a paper check. Paper checks will be available for pick up with a valid photo ID at the Honoka’a Hospital Business Office.

- Former Ka’u Hospital or the Ka’u Clinic employees, will be issued a paper check. Paper checks will be available for pick up with a valid photo ID at the at the Ka’u Hospital Business Office.

- Former East Hawaii Health Clinic (EHHC) employees, will be issued a paper check. Your pick-up location will be the same as former Hilo Benioff Medical Center employees. Please see bullet point one for your pick-up information.

6. What happens if I am unable to pick up my check in-person on March 20-21, 2025? (Applies to both former and current employees)

Any checks not collected by 3:15 p.m. on March 21, 2025, will be mailed via certified mail with return receipt requested to the employee’s last known address no later than March 28, 2025.

7. I currently live off island and am unable to pick up my check. How will I receive my check?

Employees with last known address not on the island of Hawaii will have checks mailed out no later than March 28, 2025.

8. Am I able to designate someone to pick up my THP check?

No, only the Active/former employee may pick up their checks with a valid photo ID.

October 2024 HGEA-HHSC Temporary Hazard Pay Frequently Asked Questions

1. What is the purpose of HGEA Temporary Hazard Pay and who does it apply to?

A: The settlement offer is to resolve the pending class grievances regarding temporary hazard pay for the period of March 4, 2020 through March 25,2022 for those who worked and were exposed to COVID-19 during the pandemic, and is applicable to all employees in bargaining units 2, 3, 4, 9,13, and 14, including Employees not administratively assigned (SRNA, exempt included employees) employed with the State of Hawaii Executive Branch, Judiciary, Hawaii Health Systems Corporation, University of Hawaii and Public Charters Schools.

2. I am a former employee of HHSC East Hawaii Region. Am I still eligible to receive the Temporary Hazard Pay awarded in this Settlement Agreement?

A: Yes, affected employees who are no longer employed are still eligible for the lump sum payments, provided they complete and submit the required self-assessment form by July 31, 2024.

3. Do I need to complete the self-assessment form?

A: Yes, per the HGEA and HHSC Temporary Hazard Pay Settlement Agreement, all affected employees will be required to complete and submit a form to self-assess and document their tier placement.

4. What is the due date to complete my self-assessment?

A: The due date for all self-assessment forms will be July 31, 2024.

5. What are the three tiers compensation value?

A: Tier 1 – $20,000; Tier 2 – $10,000; Tier 3 – $0.00

6. Will I be taxed on my Temporary Hazard Pay payment?

A: Per the Settlement Agreement, “HHSC shall withhold all taxes and retirement contributions required by law for the affected employees. Union dues will also be deducted from this payment. Affected Employees are responsible for all tax liabilities incurred as a result of this Settlement Agreement.”

7. Will these Temporary Hazard Pay payments be reported to the Employees’ Retirement System (ERS)?

A: Yes, per the terms of the Settlement Agreement, the Employer will report payouts to the ERS, broken down by pay period.

8. Will these Temporary Hazard Pay payments affect my ERS retirement benefits?

A: The Temporary Hazard Pay lump sum payments are creditable for ERS purposes only for employees who became an ERS member before July 1, 2012 pursuant to Hawaii Revised Statues, Chapter 88-21.5.

9. ** UPDATED 9/27/24** I am a current employee of HHSC East Hawaii Region. If eligible for Temporary Hazard Pay, how will I be paid?

A: The Temporary Hazard Pay will be paid as two lump sum installments. For current employees, these payments will be processed separately from your bi-monthly paycheck. If you are currently enrolled in direct deposit, your payments will be via direct deposit. If you are not currently enrolled in direct deposit, you will receive a check in paper form. Checks will be available for pick-up with a valid ID at the pickup location listed below, on October 4, 2024, from 12:30- 3:30 p.m. Check distribution will continue during normal working hours 7:00 a.m. – 3:30 p.m. Monday through Friday starting on October 7, 2024 until all checks are collected.

- For employees who are employed with Hilo Benioff Medical Center, your pick-up location will be at HBMC Payroll Office located at 140 Rainbow Dr. Hilo, HI

- For employees who are employed with Honoka’a Hospital, formerly Hale Ho’ola Hamakua, your check pickup location will be at the Honoka’a Hospital Business Office located at 45-547 Plumeria St. Honoka’a, HI

- For employees who are employed with Ka’u Hospital or the Ka’u Clinic, your pickup location will be at the Business Office located at 1 Kamani St. Pahala, HI

- For employees who are employed with an East Hawaii Health Clinic (EHHC), your pick-up location will be at the HBMC Payroll Office located at 140 Rainbow Dr. Hilo, HI.

10. ** UPDATED 9/27/24** I am a former employee of HHSC East Hawaii Region. If eligible for Temporary Hazard Pay, how will I be paid?

A: For departed employees, you will be issued a paper check. Paper checks will be for pick up with a valid ID, on October 4, 2024, from 12:30-3:30 p.m. at the locations listed below. Check distribution will continue on October 7, 2024, until October 18, 2024, during normal working hours 7:00 a.m. -3:30 p.m. Monday through Friday.

- For former employees who were last employed with Hilo Benioff Medical Center, your pick-up location will be at HBMC Payroll Office located at 140 Rainbow Dr. Hilo, HI

- For former employees who were last employed with Honoka’a Hospital, formerly Hale Ho’ola Hamakua, your check pickup location will be at the Honoka’a Hospital Business Office located at 45-547 Plumeria St. Honoka’a, HI

- For former employees who were last employed with Ka’u Hospital or the Ka’u Clinic, your pickup location will be at the Ka’u Hospital Business Office located at 1 Kamani St. Pahala, HI

- For former employees who were last employed with an East Hawaii Health Clinic (EHHC), your pick-up location will be at the HBMC Payroll Office located at 140 Rainbow Dr. Hilo, HI

11. **UPDATED 9/27/24** What happens if I am unable to pick up my check prior to October 18, 2024? (Applies to both former and current employees)

A: Any checks not collected by 3:30 p.m. on October 18, 2024, will be mailed via certified mail with return receipt requested to the former employee’s last known address no later than October 30, 2024.

12. **UPDATED 9/27/24** I currently live off island and am unable to pick up my check. How will I receive my check?

A: Employees with last known address not on the island of Hawaii will have checks mailed out no later than October 7, 2024.

13. **UPDATED 9/27/24** Am I able to designate someone to pick up my THP check?

A: No, only the Active/former employee may pick up their checks.

14. ** UPDATED 9/27/24** If am eligible to receive, the Temporary Hazard Pay, when will the two installments be paid?

A: The first payment will be October 4, 2024 and the second payment will be in March 2025.

15. What does the self-assessment mean by, “I worked a 5-8 regular work week schedule”?

A: This statement applies if you were scheduled to work 8-hour shifts, 5 days per week as a 100% FTE employee.

16. What does the self-assessment mean by, “I worked a 4-10 alternate work week schedule”?

A: This statement applies if you were scheduled to work 10-hour shifts, 4 days per week as a 100% FTE employee.

17. What does the self-assessment mean by, “I worked a 3-12+4 work week schedule”?

A: This statement applies if you were scheduled to work 12-hour shifts, 3 days per week and a 4-hour shift, 1 day per week as a 100% FTE employee.

18. What does the self-assessment mean by, “3-12 work schedule”?

A: This statement applies if you were scheduled to work 12-hour shifts, 3 days per week as a 90% FTE employee.

19. I am a former employee, what do I enter on the self-assessment form for “Facility” and “Department”?

A: Please enter the last facility and department you worked for under HHSC East Hawaii Region.

20. What counts as a “day” worked?

A: A day is counted if you physically reported to work on a scheduled workday, regardless of duration.

21. Did I need to have worked my entire scheduled shift to count that day?

A: No, physically working your entire shift is not a requirement to receive credit for the day. A day is counted as long as you physically reported to work on a scheduled workday, regardless of duration.

22. What if I worked more than one type of schedule during March 4, 2020 through March 25, 2022 (i.e.: A 5-8 then a 3-12 due to a drop in FTE)?

A: To qualify for the lower minimum number of days, you must have worked the corresponding alternate work week schedule for a majority of the working days on and/or between March 4, 2020 through March 25, 2022.

23. What is a Form 7?

A: The Form 7 is generated per calendar year and shows you hours worked or leave utilized per day. The left side of the page contains the month, the header of each column contains the days of the month, and the top left of the page show you the calendar year.

Each day will contain a code and corresponding hours, if applicable.

The following codes are used on the Form 7:

| R= Regular | H= Holiday | I= Accidental Injury | A= Admin. Time Off |

| E= Extra Time Retro | V= Vacation | W= Workers Compensation | L= Leave Without Pay |

| O=Over Time Work | S= Sick | D= Vacation Leave Donated | X=Standby |

| ——= Day Off | T= Comp Time Off | P= Vacation Leave Received | E= CT Earned |

24. What codes should I be looking for on the Form 7 to calculate my days applicable?

A: You should look for all days containing the code, R, for “Regular” days worked. These days should be counted if you physically reported to campus.

25. What should I be excluding when calculating my applicable days worked?

A: You should not count days that consisted only of:

- Vacation Leave

- Sick Leave

- Holiday Pay

- Compensatory time off

- Worker’s compensation

- Telework or work from home arrangements

- Administrative leave with or without pay

- Leave without pay

- Families First Coronavirus Response Act Leave

- Family and Medical Leave Act Leave

- Overtime hours and other salary consideration

26. Who do I contact if I have questions on how to fill out the self-assessment or what tier I belong in?

A: Please email ehihazard@hhsc.org. All emails will be responded to by the close of the next business day. **Please refrain from reaching out to the Human Resources main phone line or the Payroll Department.**

27. What happens after I submit my self-assessment form?

A: After your form is received, it will be reviewed by Human Resources to confirm your tier placement, then routed to our Regional Chief HR Officer for final approval. Human Resources will then send all employee tier placement information to HHSC Corporate HR Office for continued processing. You will receive a copy of the self-assessment form from Adobe e-sign once the Regional Chief HR Officer approves or denies your self-assessment.

28. What happens if my self-assessment is denied?

A: If your self-assessment is denied, it is due to HR calculating a different tier placement then what is reported on your self-assessment. Once denied, you will receive a copy of your self-assessment form via Adobe e-sign and will be asked to submit a new self-assessment. If further discussion is needed between you and HR, a phone meeting will be scheduled.

29. What happens if I still don’t agree with HR’s determination after our meeting?

A: In the event of a disagreement between you and the Employer regarding tier placement, you will have 30 calendar days to present information/documentation to substantiate a different tier placement to the Regional CEO by emailing ehihazard@hhsc.org.

30. What happens if I still don’t agree with the Regional CEO’s determination of my tier placement?

A: In the event there is still a disagreement, the Union (HGEA) will have 30 calendar days from the Regional CEO’s response to present information/documentation to substantiate a different tier placement to a mutually agreed upon 3rd party for review and final decision making.

31. I was in a position that fell within an UPW Bargaining Unit and transferred into or from a position that fell within an HGEA Bargaining Unit 2, 3, 4, 9,13, or 14. How do I calculate my applicable days worked to determine my tier placement?

A: You should only count your applicable days worked while under an HGEA Bargaining Unit from March 4, 2020 through March 25, 2022 as this THP Settlement Agreement only applies for HGEA members. Your days worked during this time period as a UPW member will need to follow the agreement (once settled/finalized) with the State of Hawaii and UPW.

32. I was in a casual hire position and transferred into or from a position that fell within HGEA Bargaining Unit 2, 3, 4, 9,13, or 14. How do I calculate my applicable days worked to determine my tier placement?

A: You should only count your applicable days worked while under an HGEA Bargaining Unit from March 4, 2020 through March 25, 2022 as this THP Settlement Agreement only applies for HGEA members. Your days worked during this time period as a Casual Hire will not be applicable in determining your tier placement.

33. I was in an exempt position and transferred into or from a position within HGEA Bargaining Unit 2, 3, 4, 9,13, or 14. How do I calculate my applicable days worked to determine my tier placement?

A: You should count all applicable days worked in both your exempt position and while under a HGEA Bargaining Unit from March 4, 2020 through March 25, 2022 as this THP Settlement Agreement applies to both HGEA Bargaining Units 2, 3, 4, 9,13, and 14 as well as Employees not administratively assigned (SRNA, exempt included employees) employed with Hawaii Health Systems Corporation.

34. I am an UPW member, when we get our Temporary Hazard Pay?

A: The State of Hawaii and UPW are still in the process of settling claims for UPW members.